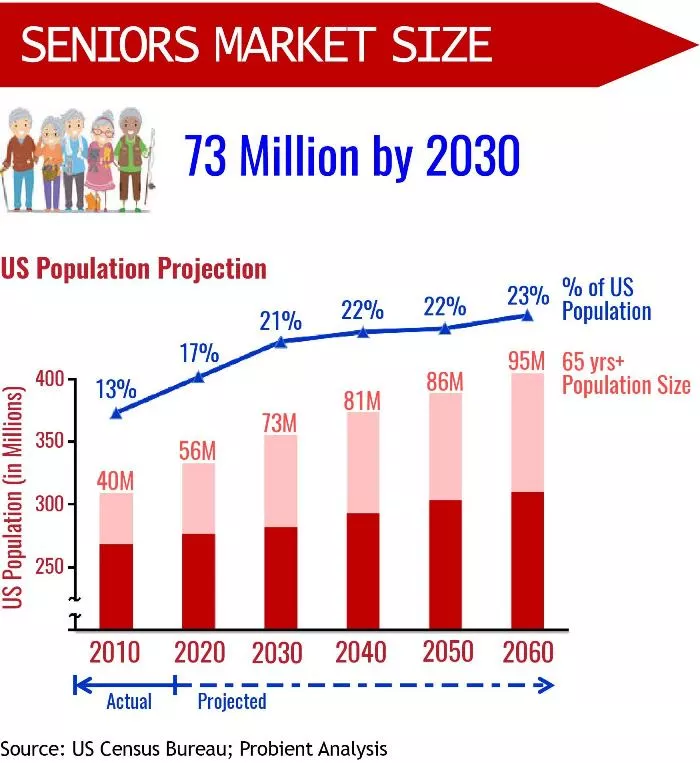

The fastest growing demographic in the US this decade.

Current population estimates by the US Census Bureau show that the 65-years-and-older demographic will be the fastest growing segment between now and 2060. This decade (the 20s), the senior population is projected grow by 30% as all baby boomers would have turned 65 by the end of the decade.

40 million baby boomers

are turning 65 this decade.

Over 40 million baby boomers will join the cohort, creating a powerful market segment of 73 million seniors. This translates to over 10,000 boomers turning 65 each day this decade.

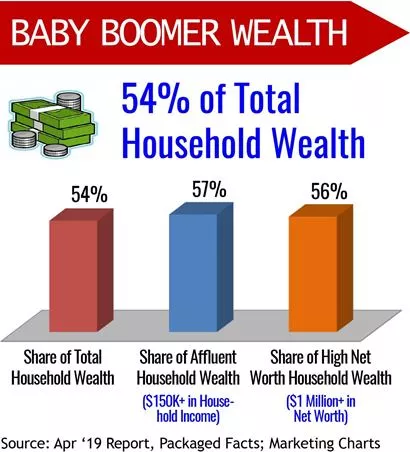

54% of US household wealth is currently owned by the Baby Boomers. According to recent figures from Epsilon, a transactions database company, Boomers spend a whopping $550 Billion annually, the highest among all generations. They outspend Gen X, the second highest, by almost $200 Billion.

Baby Boomers also dominate two other measures – number of households with $150K in annual income and number of households with net worth of a million dollars or more.

According to the Federal Reserve’s most recent Survey of Consumer Finances, the average net worth of baby boomers is $1.1 million, the highest among all age groups.

Seniors account for 36% of National Health Expenditure.

Currently, seniors account for $1.2 trillion of the total spend – more than one-third of NHE ((National Health Expenditure) in the US. A recent analysis by the Kaiser Family Foundation showed that baby boomers account for 56% of the total spend.

Medicare cost in 2018 was over $700 billion, financing one-fifth of the total health spending. According to CMS, NHE is projected to grow at an average annual rate of 5.5% to reach nearly $6 trillion by 2027.

The Durable Medical Equipment (DME) market is projected to grow at a brisk 6.3% annually this coming decade. Medicare spending on DME is estimated to be over $61 billion in 2019 (based on the 2017 National Health Expenditure Accounts (NHEA) data released by CMS). Durable Medical Equipment includes Orthopedic Braces, Blood Sugar Monitors, Diabetic Supplies and Incontinence Products.

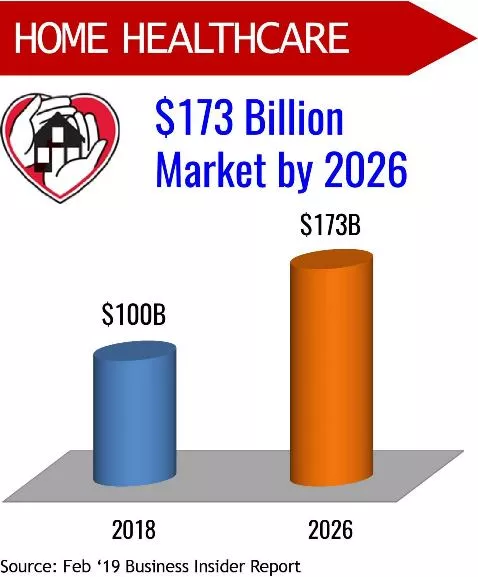

Home Healthcare is one of the fastest growing segments.

Home Healthcare is one of the fastest growing segments in the healthcare services industry. It is projected to grow 7% annually from about $100 billion in 2018 to $173 billion in 2026 (Source: Business Insider Intelligence 2019 Report).

The Home Healthcare market includes both skilled and non-skilled (including daily activities of living) care. A key ruling by CMS (Centers for Medicare & Medicaid Services) in April 2018 allowing coverage of certain non-skilled care under the Medicare Advantage (MA) plans is aiding the surge in this market. An increasing number of health plans are starting to incorporate these benefits into the MA plans.

Senior Living providers struggling with lower occupancy rates – as seniors are living healthier and preferring to stay in their homes – are seeing this CMS ruling as a potential additional source of revenue and are extending their breadth of services to include non-skilled care.

Senior Living providers struggling with lower occupancy rates – as seniors are living healthier and preferring to stay in their homes – are seeing this CMS ruling as a potential additional source of revenue and are extending their breadth of services to include non-skilled care.

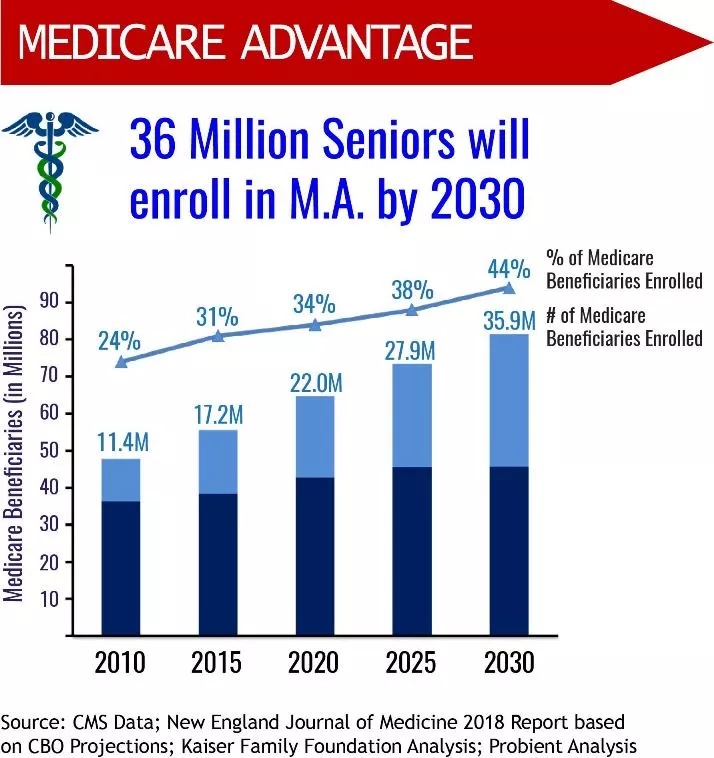

Medicare Advantage will see 14 Million new enrollees.

Medicare Advantage and Medicare Supplemental Insurance Plans are projected to grow significantly in the next 10 years. The booming senior market is providing insurance agencies/ agents and financial consultants attractive growth opportunities.

The Medicare Advantage Plans (also Part C) are network-based managed-care plans that cover the original Medicare (Parts A & B) along with varying levels of additional benefits. United Healthcare, Humana and BCBS account for over 50% of MA enrollees currently.

Medicare Supplements – as the name suggests – supplement Medicare. While Medicare is the primary insurance, gaps in the coverage are picked up by Supplements (hence, they are also called Medigap plans). Supplements are standardized and currently 11 plans are in the marketplace with Plan F being the most popular (with over 50% market share).

Medicare Supplements – as the name suggests – supplement Medicare. While Medicare is the primary insurance, gaps in the coverage are picked up by Supplements (hence, they are also called Medigap plans). Supplements are standardized and currently 11 plans are in the marketplace with Plan F being the most popular (with over 50% market share).

Marketing to seniors about the plans must follow guidelines set forth by CMS. The most recent updated MCMG (Medicare Communications and Marketing Guidelines) is available on the CMS website. CMS started allowing agents and brokers to initiate unsolicited contact via email (provided the email contains an opt-out) in addition to traditional sources of marketing – direct mail and print media. A beneficiary may be contacted over the phone if the beneficiary provided permission.

Spending Power of Seniors is $2.8 Trillion.

Seniors lead all other age groups in purchases across categories including vacations, luxury goods, and new vehicles. The mean disposable income per household of seniors was over $50K in 2017 (Source: Statista, 2019)

Seniors spend over 20 hours a week online. Majority of that time is spent on smartphones or tablets. As this segment gets more comfortable with technology – over 50% shop online – an increasing share of the total spend is being captured by online sales. According to AARP, one-third of all online purchases are made by people over 50; and seniors spend nearly $7 billion online each year.

Seniors spend over 20 hours a week online. Majority of that time is spent on smartphones or tablets. As this segment gets more comfortable with technology – over 50% shop online – an increasing share of the total spend is being captured by online sales. According to AARP, one-third of all online purchases are made by people over 50; and seniors spend nearly $7 billion online each year.

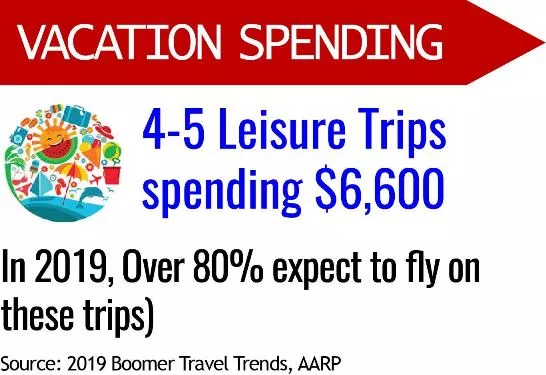

A recent AARP survey found that boomers planned to spend about $6,600 in 2019 on vacation travel consisting of 3-4 trips. Most will travel domestically but over half of the group planned at least one international trip.

Flying continues to be the dominant transportation choice and almost two-thirds plan to stay in hotels/ motels. Boomers’ enrollment in loyalty programs (airways, hotels, rental cars, cruise programs) is high (over two-thirds) and fully use these programs to plan their trips.

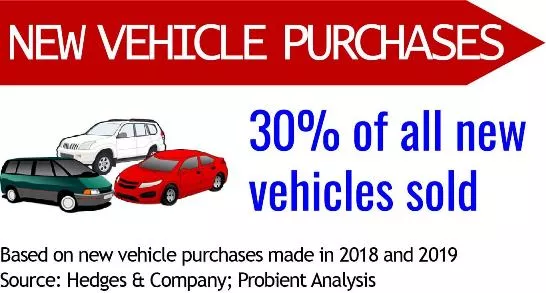

Seniors are currently purchasing about 30% of all new vehicles sold, based on the recently published report this year by Hedges & Company. 45% of all new compact SUVs sold were to baby boomers (Source: Cox Automotive Study, Feb 2019).

What are your plans to address the needs of this market?

Probient specializes in generating quality opt-in leads in the Seniors market. We have developed innovative techniques that enable us to reach out to the target market and screen potential customers customized to each client’s needs.

Probient has been a leader for 20 years, serving clients in multiple industries offering products and services to seniors that include:

Healthcare

Services

- Durable Medical Equipment

- Home Healthcare

- Senior Living Options

Insurance &

& Financial Serv.

- Health Plans

- Mortgage ReFinancing

- Insurance Products

Travel &

Tourism

- Vacation Packages

- Cruises

- Travel & Lodging